Loading map…

-

Thomas Kinkade Gallery Of Monterey

At Thomas Kinkade Gallery Of Monterey, we are a group of Thomas Kinkade Signature Galleries serving the Monterey Bay, Central Coast, and Northern California area….

- Categories: Home Decor

- Phone: (831) 747-2834

- Email: tkmonterey@kinkade.com

- Address: 381 Cannery Row,, Monterey, CA, 93940, United States

-

Artistic Iron Works

Serving the Las Vegas Valley since 1971, Artistic Iron Works is a family-run, veteran-owned state-of-the-art 33,000 sq ft ornamental iron gallery and custom fabrication facility…

- Categories: Doors

- Phone: (702) 387-8688

- Email: tina@artisticiron.com

- Address: 105 W. Charleston Blvd., Las Vegas, NV, 89102, United States

-

The Window Source of The South

- Categories: Windshield Repair

- Phone: 6782575036

- Email: cpowers@thewindowsource.net

- Address: 1385 East, GA-166, Bowdon, GA, 30108, United States

-

International Travel Permit

Get your IDP quickly with our instant IDP service India users trust. Apply now at internationaltravelpermits.com for legal, secure documentation—delivered without delays.

- Categories: Automotive Roadside Service

- Address: International Travel Permits No 7 Temasek Boulevard #12-07, Suntec, Suntec, 038987, Singapore

-

Thomas Kinkade Studios

The Thomas Kinkade Company has published the works of Thomas Kinkade for over 25 years and through unique sales and marketing efforts, Thomas Kinkade has…

- Categories: General

- Email: k.batista@artbrand.com

- Address: 2850 W. Horizon Ridge Parkway, Suite 200, Henderson, NV, 89052, United States

-

Simply Cooling, Heating & Plumbing

Simply Cooling, Heating and Plumbing is owned by two native Las Vegans who are best friends. Our company is committed to providing the Best services…

- Categories: Air Conditioning Contractor

- Email: simplyac702@gmail.com

- Address: 3401 W Sirius Ave Ste 12, Las Vegas, NV, 89102, United States

-

Advantage Landscape

Advantage Landscape is the premier provider of landscape services for Las Vegas. We are providing professional landscape design, desert landscaping, turf installation, pavers, plant installation,…

- Categories: Home Improvements

- Phone: (702) 873-2401

- Address: 5490 S Rainbow Blvd #2003, Las Vegas, NV, 89118, United States

-

Dataforma

Dataforma is a Cloud-based field service management software with project and business management features designed for commercial contractors.

- Categories: Contractors Equipment & Supplies

- Phone: (415) 845-3440

- Address: 410 Kings Mill Rd,, York, PA, 17401, United States

-

Capital Chimney Corp

Are you interested in our products or services? Contact us today. Tell us a bit about your chimney problems, and our staff can help you figure out the right solutions.

- Categories: Chimney Cleaning

- Phone: (630) 670-6535

- Address: 704 N Addison Rd, Villa Park, IL, 60181, United States

-

Blinds Wholesaler

Come to Blind Wholesaler to get the best window treatments like shutters, blinds, roller shades, curtains, drapes and solar shades at wholesale prices for your home or business. We aim to provide a level of customer service that is second to none, first and foremost. We also provide free in-home estimates where we can bring…

- Categories: Draperies, Curtains, Blinds & Shades Installation

- Phone: 702-456-5555

- Address: 6351 Hinson Street, Suite #D, Las Vegas, NV, 89118, United States

-

Benchmark Environmental Engineering

Contact the professionals of Benchmark Environmental Engineering to get environmental consultation services for your commercial or residential properties.

- Categories: Mold Remediation

- Phone: (408) 448-7594

- Address: 3732 Charter Park Drive, Suite A, San Jose, CA, 95136, United States

Best Performers

-

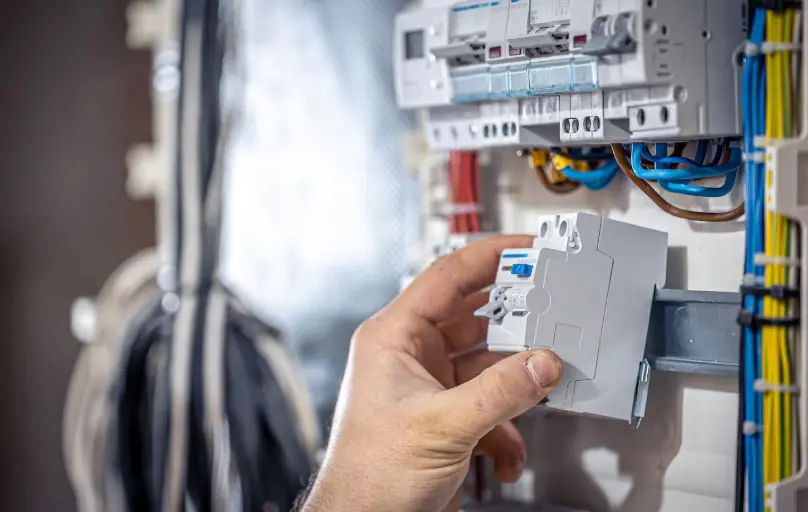

CA Electrical Group

- Categories: Electricians

- Phone: 669-260-0712

- Website: caelectricalgroup.com

Latest News & Blogs

-

How Yoga Helps You Stay Calm And Reduce Stress

Stress rarely looks dramatic. It builds quietly. Tight shoulders, shallow breathing, racing thoughts, poor sleep. You adapt to it until it feels normal. Yoga works…

-

How Exterior Electrical Work Defines A Home After Dark

A house doesn’t end at the walls. Its exterior lives its own life, especially at night. Lighting, power access, and outdoor electrical systems decide whether…

-

Why House Cleaning Feels Overwhelming

Most people don’t mind a clean home. What they mind is cleaning that never seems to end. You clean for hours, but the space still…

-

Why Healthy Skin Is Built From Habits Not Products

Skin care is often framed as a search for the right product. In reality, skin reflects how you live far more than what you apply….

-

The Electrical Upgrades People Don’t Think About

Most renovations focus on what you can see. Cabinets, floors, paint, fixtures. Electrical work usually stays invisible, so it gets pushed to the bottom of…

-

Why Home Becomes a Place of Power

A home is more than walls, furniture, and square footage. It’s the place where your nervous system finally exhales. Where you recover from noise, pressure,…

[rbdviews view=”bd-front-page” type=”front-page” filter = “5”]

[rbdviews view=”bd-front-page” type=”front-page” filter = “5”]